In a world where technological innovation constantly reshapes the way we conduct financial transactions, Ripple has emerged as a pioneering force. Ripple, also known by its digital asset XRP, is a technology company that aims to revolutionize the way money moves across borders and between financial institutions. It offers a unique approach to payments and has the potential to reshape the global financial landscape. In this article, we’ll dive deep into the Ripple network, exploring its background, key features, and the impact it’s having on the world of digital payments.

The Ripple Backstory

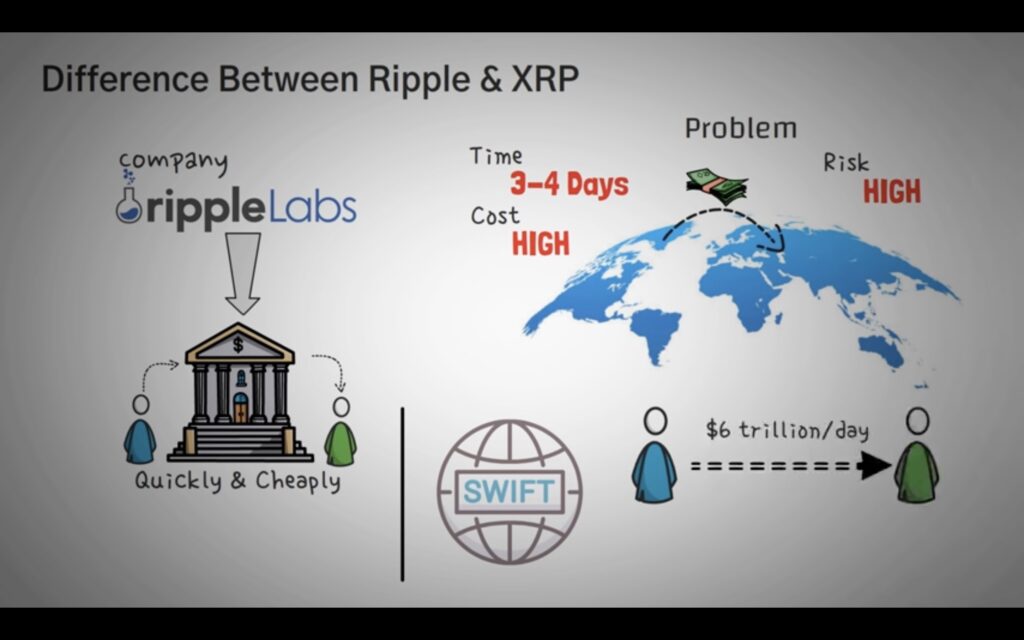

Before we delve into the technical aspects, let’s start with a brief history of Ripple. The Ripple project began in 2004 when Ryan Fugger created a precursor called RipplePay. The idea behind RipplePay was to create a decentralized platform that allowed users to create their own money and trust networks. In 2012, Chris Larsen and Jed McCaleb co-founded OpenCoin, which later became Ripple Labs. They sought to build upon the concept of a decentralized payment network and developed the XRP ledger and cryptocurrency, which is now commonly referred to as XRP.

Ripple vs. Bitcoin: Contrasting Philosophies

To truly grasp the significance of Ripple, it’s essential to differentiate it from Bitcoin, the first and most famous cryptocurrency. While Bitcoin aims to be a decentralized digital currency that enables peer-to-peer transactions without intermediaries, Ripple takes a divergent path.

Ripple is designed primarily for facilitating international transactions between banks and financial institutions. It doesn’t aim to replace existing fiat currencies but instead acts as a bridge currency, facilitating the exchange of value in a seamless and cost-effective manner. Ripple’s philosophy revolves around enhancing the traditional financial system, not disrupting it.

The Ripple Network and XRP Ledger

At the core of Ripple’s innovation is the Ripple Network and the XRP Ledger. The Ripple Network is a real-time gross settlement system (RTGS) and currency exchange network. It provides a secure and instant method for transferring money globally. The XRP Ledger, on the other hand, is an open-source blockchain protocol that underpins Ripple’s operations. It serves as the digital infrastructure for the network, enabling the creation and transfer of digital assets, most notably XRP.

Key Features of Ripple

- Speed and Efficiency: One of the primary advantages of Ripple is its speed. Transactions on the network settle within seconds, making it significantly faster than traditional cross-border payment systems that may take days. This speed is attributed to the consensus mechanism used in the XRP Ledger.

- Cost-Effectiveness: Ripple offers an affordable alternative to international transfers. Its low transaction fees make it an attractive option for financial institutions looking to reduce cross-border payment costs.

- Scalability: Ripple’s architecture allows for scalability, making it capable of handling a vast number of transactions simultaneously. This scalability is crucial for a network that aims to be adopted by major financial institutions and banks.

- Security: Ripple’s blockchain technology, like many others, is based on cryptographic security. It employs advanced security measures to protect user data and assets.

- Interoperability: Ripple is designed to work seamlessly with other networks and financial systems. This interoperability is vital for its mission to become a bridge currency and facilitate global transactions.

The Impact on Cross-Border Payments

The traditional cross-border payment system is notoriously slow, expensive, and laden with intermediaries. Banks often rely on correspondent banking relationships to facilitate international transfers, leading to a complex and time-consuming process. Ripple seeks to streamline this system by providing a direct, secure, and fast method of transferring value across borders.

Many major banks and financial institutions have recognized the potential of Ripple and have started using its technology. RippleNet, Ripple’s global network of banks and payment providers, continues to grow, connecting financial institutions worldwide. Through RippleNet, these institutions can access Ripple’s suite of products and services, which aim to transform the cross-border payment experience.

Ripple’s Vision: The Internet of Value

Ripple’s grand vision is often referred to as the “Internet of Value.” Just as the internet revolutionized the exchange of information, Ripple aspires to revolutionize the exchange of value. The Internet of Value envisions a world where money moves as freely as information, where transactions are as seamless and accessible as sending an email. Ripple’s technology is the driving force behind this vision, making it a significant player in the ongoing transformation of the global financial system.

Challenges and Controversies

Ripple’s journey hasn’t been without its share of challenges. One of the most significant controversies surrounding Ripple is its ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). The SEC alleges that XRP is a security and that Ripple conducted an unregistered securities offering. This legal dispute has implications not only for Ripple but also for the entire cryptocurrency industry, as it could set a precedent for the classification of digital assets.

Looking to the Future

Despite the legal challenges, Ripple remains a force to be reckoned with in the world of digital payments. Its commitment to bridging the gap between traditional finance and the digital world sets it apart. As the financial industry continues to evolve and embrace digital solutions, Ripple is well-positioned to play a pivotal role in shaping the future of cross-border payments.

Ripple’s vision for a digital payment revolution is gaining momentum. By providing a faster, more efficient, and cost-effective way to transfer value across borders, it’s reshaping how we think about international transactions. While challenges persist, the potential for Ripple to become a key player in the global financial landscape is undeniable. As the journey of Ripple unfolds, it’s a space worth watching, as it may well hold the key to the future of digital payments.